Israel has ‘set a global benchmark’ for medical cannabis, seeing its rich history dating back to the 1960s foster an environment of data-driven strategies and innovation.

With significant changes due to start being implemented in March this year, Prohibition Partners’ suggest in their Israel Cannabis Report, released today, that the market is set to expand even further.

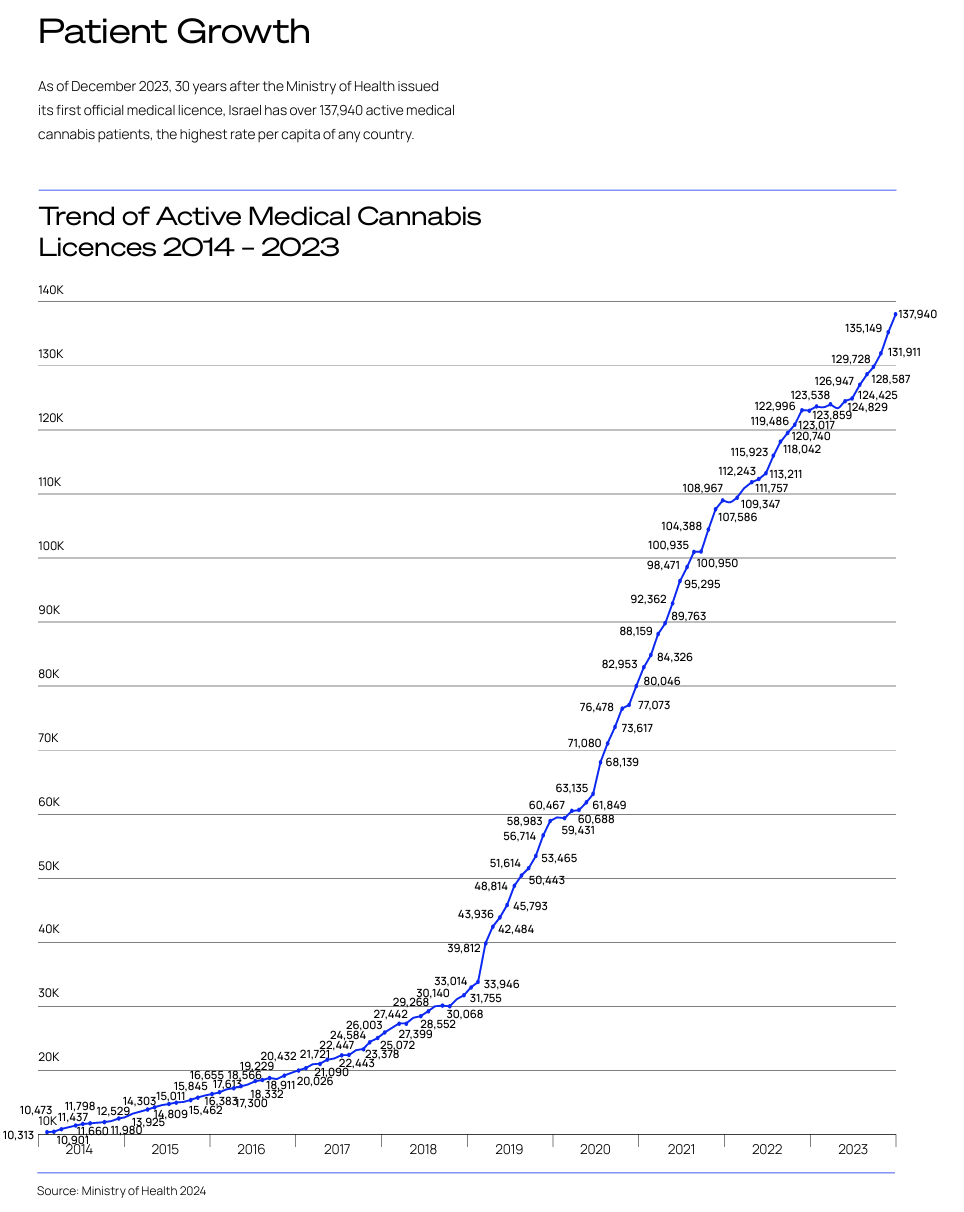

While the market already boasted 137,940 patients in 2023, marking the highest rate of access per capita of any country, these changes are expected to see the rate of growth double throughout 2024.

Its continued commitment to research and adaptive regulatory framework are set not only to ensure its continued place at the forefront of medical cannabis, but also its influential role in shaping global cannabis.

Medical cannabis in Israel

Israel has been at the cutting edge of medical cannabis research since the 1960’s, when Israeli scientists Raphael Mechoulam and Yechiel Gaoni successfully isolated tetrahydrocannabinol (THC) & cannabidiol (CBD) from cannabis thereby opening doors for dozens of cannabis researchers around the world.

In the 1990s, Israel became one of the first countries to recognise cannabis’ medicinal potential, particularly for cancer and chronic pain, seeing its military adopt THC to treat post traumatic stress disorder (PTSD) in 2004.

By 2012, a year after the establishment of the Israel Medical Cannabis Association (IMCA), around 10,000 patients held a licence to access medical cannabis..

A crucial development was the publication of the ‘Green Book’ in 2016, a procedural instruction booklet aimed at formulating a consistent framework for medical cannabis treatment.

Alongside helping shape global medical cannabis strategy, the Green Book also helped formulate Israel’s ‘new regulation’ that same year, which standardised medical cannabis costs at a fixed price, regardless of a patient’s monthly dosage, seeing supply given directly from supplier to patient.

This was a major driver of patient growth, seeing the number of licensed patients increase by over 22% between June 2016 and June 2017, topping 30,000 by 2018.

In 2019, following the full implementation of these reforms, patient numbers doubled once again, hitting 59,431 by February 2020.

With the introduction of pharmacies as intermediaries between patients and growers, the fixed prices on products were also removed, while Israel began allowing medical cannabis imports to meet demand.

Upcoming changes expected to boost growth even further

Now, a new set of reforms set to be implemented over the coming months are expected to see a similar transformation in both the size and accessibility of the market.

These new regulations are aimed at improving patient access and quality of treatment, while boosting Israel’s export potential by harmonising its standards with EU-GMP.

Currently, medical cannabis patients are required to obtain a licence in order to receive medical treatment, which must be periodically renewed.

Patients are currently required to navigate a complex bureaucratic framework, with a limited number of doctors who obtain a ‘manager’ certification tasked with reviewing all applications from specialist doctors on behalf of their patients.

This leads to a disconnect between a patient’s medical cannabis treatment and their regular medical care, encouraging gaps in communication and coordination between the different healthcare providers.

Soon, however, Israel will transition to a ‘prescription’ model and move away from the licensing system altogether.

Set to begin a trial in late March 2024, the new model will see medical cannabis treated similarly to other controlled medications, enabling certified doctors to prescribe cannabis directly to patients and integrate cannabis treatment into their regular medical files.

Furthermore, cannabis will no longer be considered a ‘last resort’, requiring patients to provide proof they have tried all other forms of treatment before being allowed access.

These changes are expected to lead to significant patient growth, particularly among older individuals who are likely to feel more at ease accessing cannabis as it is integrated into their regular healthcare ecosystem.

Going beyond medical cannabis, this shift is also expected to reduce demand for illicit cannabis as it becomes more accessible through legitimate channels.

Bazelet’s Head Of Business Development, Itai Rogel, said that he believed these changes will mark a ‘turning point’, but will ‘take time’ to implement.

“Cannabis treatment under prescription from the health bodies will not represent the majority of cannabis patients – so patients with pain and PTSD will still access cannabis under licence from the government. It does mean that around 15% of current licences will convert into prescriptions.

“Some believe the new prescriptions will double patient numbers, but I’m not as confident about such a significant impact. The process for prescriptions will take time—each health provider will have its own call centre, centralising the evaluation and approval of prescriptions.

“It’s a meticulous process given the complexities involved, and these organisations are cautious in their approach. As suppliers, we understand and respect this cautious process, preferring cooperation over resistance, ensuring they move forward on the right path.